Here’s the GOP’s rationalization for the sequester:

…Representative Cathy McMorris Rodgers of Washington State, the chairwoman of the Republican conference, also called the cuts “devastating” to America, but said that Republicans in the House would not yield on the issue of taxes.

“Spending is the problem, which means cutting spending is the solution,” she said. “It’s that simple.”

Let’s take a look at President Obama’ spending in historical comparison. As you can see in the chart below, President Obama has presided over the lowest rate of government spending in a very long time.

How does US government spending compare with that of other members of the Organization of Economic Cooperation and Development (OECD)? (NOTE: All figures below reflect the situation BEFORE the sequester cuts began to be implemented.)

Social Spending

The US was ranked number 22 out of 30 in terms of social spending as a percentage of GDP in 2012:

Public Social Spending as a Percentage of GDP

| France |

|

29.9 |

| Denmark |

|

29.5 |

| Belgium |

|

28.6 |

| Austria |

|

28.1 |

| Finland |

|

28.0 |

| Sweden |

|

26.5 |

| Italy |

|

26.4 |

| Germany |

|

25.8 |

| Portugal |

|

25.4 |

| Spain |

|

25.3 |

| Slovenia |

|

23.7 |

| Luxembourg |

|

23.6 |

| Greece |

|

23.1 |

| United Kingdom |

|

22.9 |

| Norway |

|

22.4 |

| OECD-34 |

|

22.1 |

| Hungary |

|

22.1 |

| New Zealand |

|

21.8 |

| Netherlands |

|

21.5 |

| Poland |

|

21.1 |

| Czech Republic |

|

20.4 |

| Ireland |

|

19.8 |

| United States |

|

19.5 |

| Canada |

|

19.3 |

| Switzerland |

|

18.5 |

| Estonia |

|

17.3 |

| Slovak Republic |

|

17.0 |

| Australia |

|

16.1 |

| Israel |

|

15.7 |

| Iceland |

|

14.0 |

| Korea |

|

9.7 |

(Source: OECD)

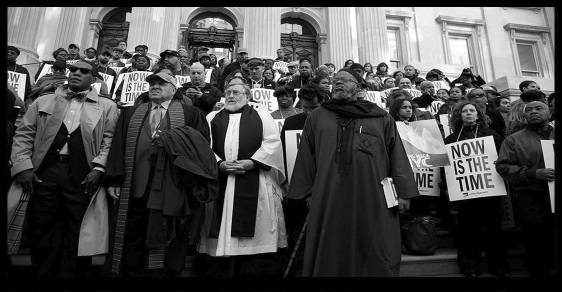

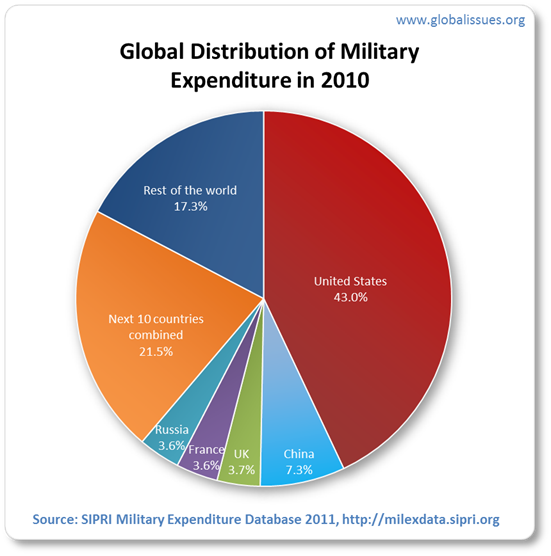

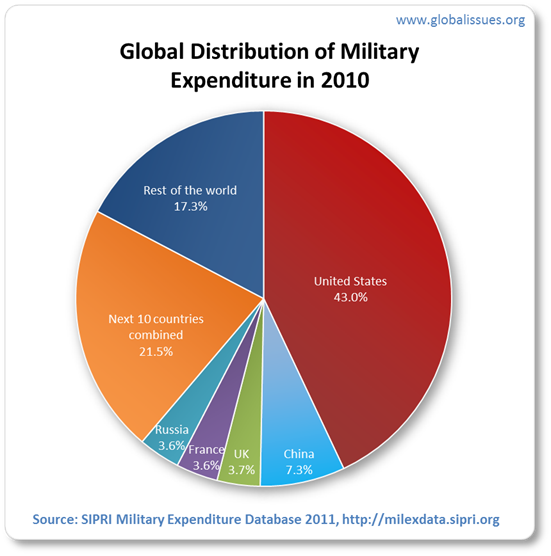

Military

Meanwhile, US military spending represents 43.3% of the world’s total in that category—by far the highest of any country on earth. Many in the GOP tried to prevent cuts to military spending in the recent showdown over the sequester, and there are reports that the GOP will attempt to return military spending to its pre-sequester levels in the upcoming Continuing Resolution. Clearly, as far as the GOP is concerned, all spending is created equal, but some is more equal than others.

Social Consequences

What have we been getting for our money?

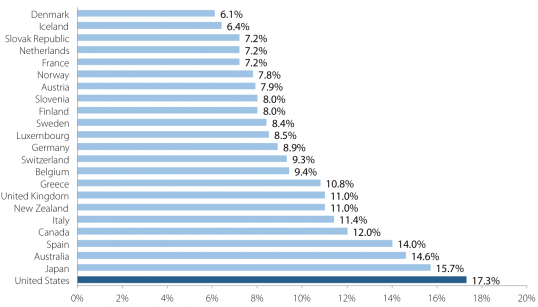

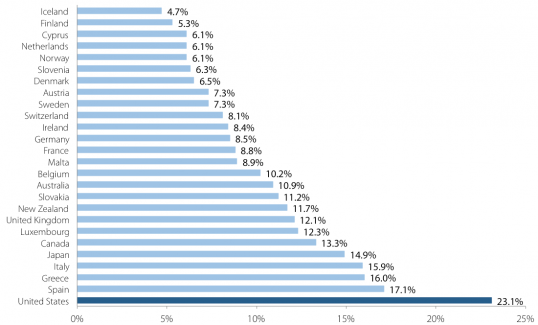

As you can see in the chart below, we have the highest poverty rate of any of the OECD countries listed below.

Relative poverty rate in the United States and selected OECD countries, late 2000s

Source: EPI

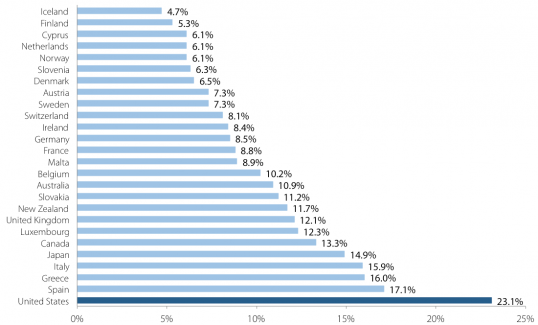

Similarly, we have the highest child poverty rate of any developed country in the OECD.

Child poverty rate in selected developed countries, 2009

Source: EPI

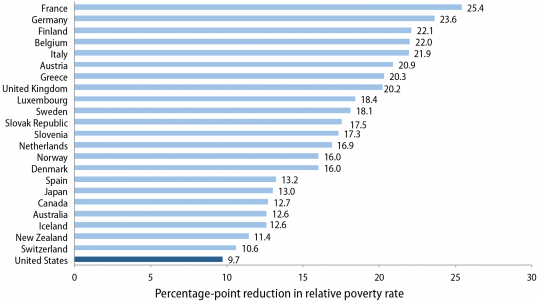

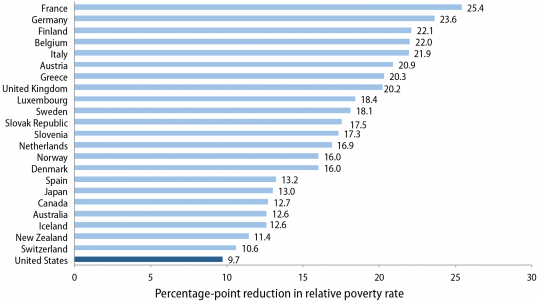

Moreover, US social welfare spending is less effective in reducing the relative poverty rate than that in any other OECD country listed below.

Extent to which taxes and transfer programs reduce the relative poverty rate, selected OECD countries, late 2000s

Source: EPI

Source: EPI

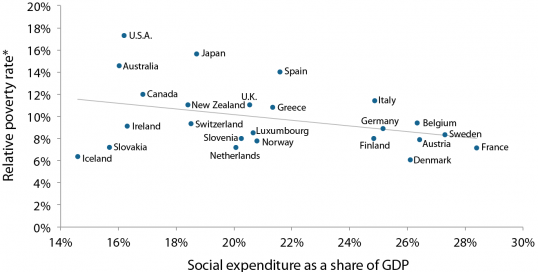

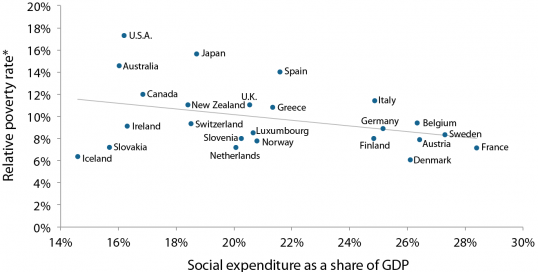

The relationship between our relatively meager social spending and our poverty rate indicates that the low level of the former is related to the high level of the latter.

Social expenditure and relative poverty rates in selected OECD countries, late 2000s

Source: EPI

Life Expectancy

According to the CIA Factbook, the United States ranks 51st out of 222 countries, behind every Western European country, Japan, Australia, Hong Kong and even Bosnia and Herzegovina.

Teenage Pregnancy

The US has the highest rate of teenage pregnancy of the 25 countries ranked by the CIA Factbook. A graphic representation of this data can be found here.

Taxation Rates

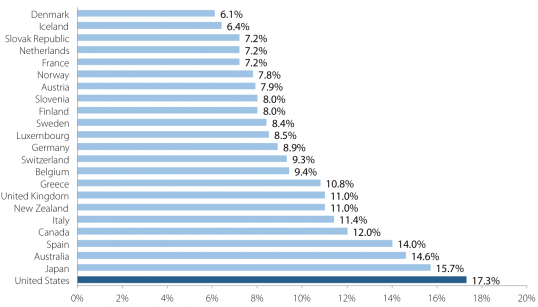

Meanwhile, the GOP is adamantly opposed to raising taxes to reduce the deficits and debt. Their refusal to allow any taxes to rise led them to prevent any alternative to the sequester to come up for a vote in Congress. What do US tax rates look like compared to other OECD countries?

US taxes as a percentage of GDP are lower than those of any countries except Turkey, Chile and Mexico, as shown below:

So the GOP has forced arbitrary, indiscriminant and draconian spending cuts on the US government at a time when (a) we’re already spending at a much lower level than any other US administration since Eisenhower; and (b) our very low rate of social spending is strongly correlated with our very high rates of poverty, teenage pregnancy and relatively low life expectancy. They have done so while refusing to allow a penny more in tax increases, despite the fact that the US already has one of the lowest rates of individual taxation of any industrialized country.

Economic Effects of the Sequester

It is estimated that the sequester cuts will cause 750,000 people to lose their jobs in 2013 alone. The Congressional Budget Office (CBO) has estimated that the cuts will reduce GDP in 2013 by about half of a percentage point—this at a time when unemployment is about 8% and GDP growth is about 2.5%. The CBO estimates further that the economy will go into recession for much of 2013 as a result of the cuts.

Here are the Office of Management and Budget (OMB) estimates of the programs that will be cut:

- Aircraft purchases by the Air Force and Navy are cut by $3.5 billion.

- Military operations across the services are cut by about $13.5 billion.

- Military research is cut by $6.3 billion.

- The National Institutes of Health get cut by $1.6 billion.

- The Centers for Disease Control and Prevention are cut by about $323 million.

- Border security is cut by about $581 million.

- Immigration enforcement is cut by about $323 million.

- Airport security is cut by about $323 million.

- Head Start gets cut by $406 million, kicking 70,000 kids out of the program.

- FEMA’s disaster relief budget is cut by $375 million.

- Public housing support is cut by about $1.94 billion.

- The FDA is cut by $206 million.

- NASA gets cut by $970 million.

- Special education is cut by $840 million.

- The Energy Department’s program for securing our nukes is cut by $650 million.

- The National Science Foundation gets cut by about $388 million.

- The FBI gets cut by $480 million.

- The federal prison system gets cut by $355 million.

- State Department diplomatic functions are cut by $650 million.

- Global health programs are cut by $433 million; the Millenium Challenge Corp. sees a $46 million cut, and USAID a cut of about $291 million.

- The Nuclear Regulatory Commission is cut by $55 million.

- The SEC is cut by $75.6 million.

- The United States Holocaust Memorial Museum is cut by $2.6 million.

- The Library of Congress is cut by $31 million.

- The Patent and Trademark office is cut by $156 million.

(Source: Wonkblog